SECURITY

Securing your transactions to fight against fraud.

Excessively long payment terms, high payment failure rates, laborious and time-consuming processes, unsecured data… Whether you’re a distributor of building materials, a company specialising in planning, a stakeholder in the energy or structural work sector… Payment often represents a source of complication for your cash flow.

With SSP, there are payment solutions adapted to BtoB!

SSP offers digital payment solutions that are guaranteed, secured, and adapted to the often-high shopping basket spend experienced by BtoB companies.

Few companies use credit cards as a means of payment. Therefore, it is paramount for your business to offer an alternative with a multi-channel payment solution to meet the expectations of your customers, particularly in terms of payment facilities (deferred payment, instalments, 30-day trade credit). Indeed, your customers often need a delay between the time an order is placed and subsequent payment.

FIND OUT MORE ABOUT OUR PAYMENT SOLUTIONS

This is a payment solution that secures cheque payment acceptance.

As the first bank account payment solution on the market, SAFEDEBIT allows you to securely collect transactions by bank account in a completely digital environment.

This will be subject to a contractual guarantee in the event of non-payment and offers you flexibility in terms of payment methods (payment in full, instalment payments, deferred payments, payment carried over, security deposits).

It is you that initiates the transaction on behalf of the client. You collect bank-to-bank payments instantly. As a result, you considerably reduce transaction costs, increase the conversion rate, and can quickly dispose of the funds collected.

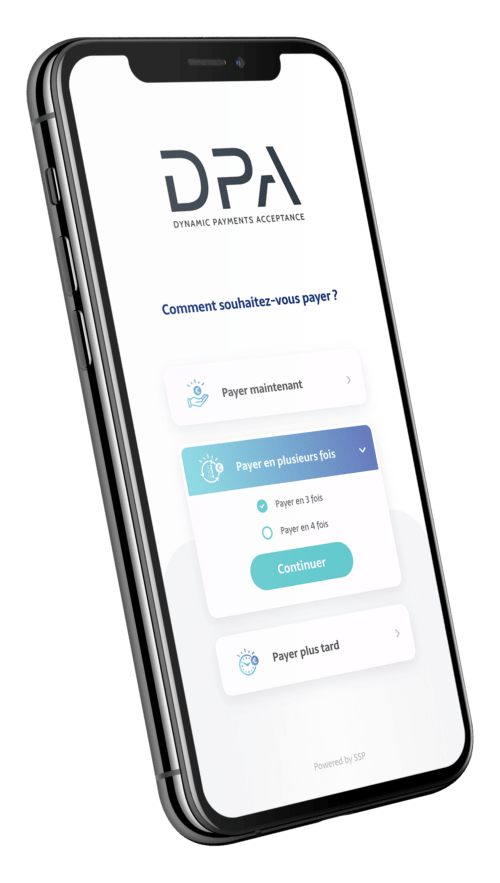

The DPA omnichannel payment platform gives your customer the option of paying in full, in instalments, or at a later date. Your customer can also choose their payment method: Credit card, SAFEDEBIT or Cheque. With a dedicated Back-Office feature, you can manage your operations and have a consolidated view of recorded payments (Dashboard, payment account access, etc.).