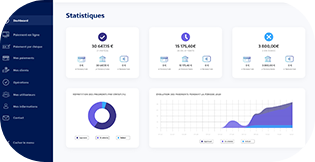

An Online and 100% digitalised payment solution

DPA is a digital and omnichannel payment platform which offers a pre-integrated and secure payment gateway. Whether your customers are ordering online, remotely or in store, let them enjoy a smooth and secure shopping experience.

In store, your customers receive a payment link that allows them to pay for their purchases using their smartphone. Online, customers are directed directly to DPA when they are ready to pay.

The customer then chooses their preferred payment method (pay now, in instalments or at a later date) before selecting their payment means (credit card, instant transfer, direct debit or wallet).