Minimise overdue payments for your services!

You work within the personal and business services sector and need to offer payment solutions. These solutions should allow you to optimise your cash management, reduce and manage outstanding payments, secure your customers’ journey, and offer a smooth and secure experience on your e-commerce platform.

Overdue payments are the reason behind 25% of business bankruptcies

In addition to the financial risk, payment management is still carried out manually and is time-consuming: with tallying, bank reconciliation and customer follow-up requirements, companies can lose up to 1 half-day per week manually entering invoices.

SSP develops digital payment solutions to allow you to quickly collect your online payments by credit card, SEPA direct debit transfer, and transfer initiation.

With SSP, you save time managing your billing and your transactions are fully secure thanks to our payment guarantee.

Find out more about our payment solutions

CHEQUE SERVICE

This is a cheque guarantee and security solution.

What are the advantages?

If you rent equipment, for example, you can secure your deposits by cheque.

SAFEDEBIT

As the first bank account payment solution on the market, SAFEDEBIT allows you to securely collect transactions by bank account in a completely digital environment.

2 main payment methods with high added value:

The direct debit will be subject to a contractual guarantee in the event of non-payment and offers you flexibility in terms of payment methods (payment in full, instalment payments, deferred payments).

It is the company that initiates the transaction on behalf of their paying customer. This represents a strong alternative to the credit card as there are no payment ceilings or risks of cancellation (payments are irreversible). The payer simply selects their bank to make the purchase and authenticates the transaction in a completely secure manner. Payment times are noticeably short, between 10 seconds (instant transfer) and 24 hours.

What are the advantages?

- As a service provider, you can easily collect recurring payments. For example, you give your customers the option of automatically paying for their subscription and additional options by direct debit.

- In the event of payment failures by deduction of contributions or charges for an insurer or lessor, payments can be retried using initiated transfer.

- You digitise your subscription process by signing an electronic direct debit mandate and secure your deposits by direct debit: the amount of the security deposit is guaranteed.

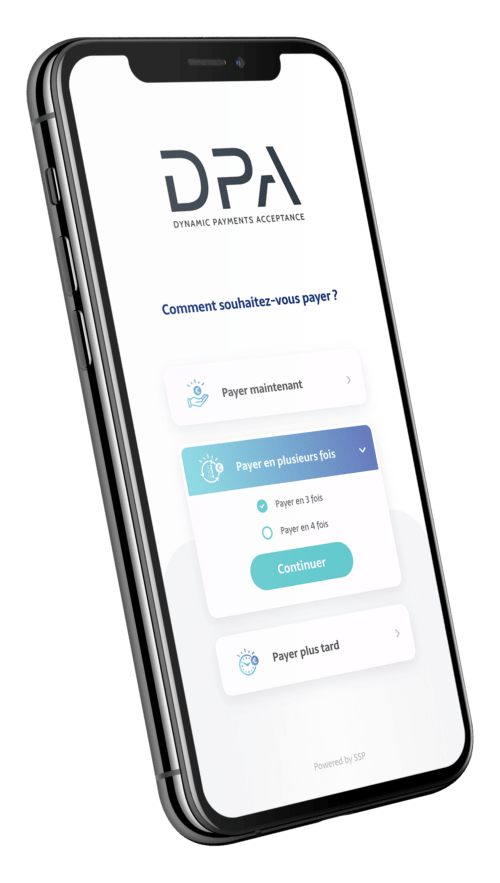

DPA (Dynamic Payments Acceptance)

The DPA omnichannel payment platform gives your customers the option of paying immediately, in instalments, or at a later date. Your customer can also choose their payment method: Credit Card, SAFEDEBIT or Cheque. With a dedicated Back-Office feature, you can manage your operations and have a consolidated view of recorded payments (Dashboard, payment account Access, etc.).

What are the advantages?

- DPA is an innovative multi-channel payment solution that satisfies all payment requirements: transaction processing, risk management, activity monitoring, financial reconciliation. You benefit from a single contract for all your services.

- You benefit from multiple payment means to significantly increase your services. These can be activated independently.

- If you are a home service provider (plumber, fitter, etc.), you can offer your customers different ways to pay once you have completed your work.

Client case study

- Add value to the CEGID Quote Invoice software by offering a service for sending payment links (the accountant can send payment links to their customers to allow them to pay invoices).

- Include a payment link on invoices.

- Offer different payment methods; credit card, bank transfer, and payment in instalments.

- Simplify invoice collection

- Strengthen the CEGID Quote Invoice software.

- Bank card & direct debits.

- Payment guarantee on direct debits.

- Saves time and simplifies accounting operations.

- Offers new payment collection methods for customers.