Do you offer the option of paying in instalments?

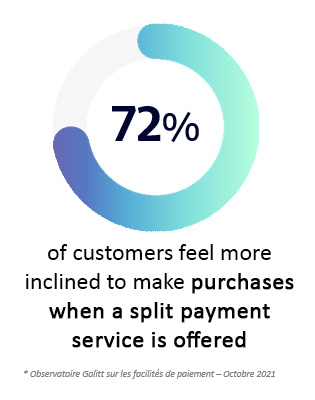

Payment in instalments consists of offering customers the option to spread out their payment over 3 or 4 instalments (free of charge), over several months. This can be to cover substantial purchases or to spread out expenditure. They pay the first monthly instalment on the same day, and subsequent payments will be automatically debited for the next few months (on the same date).

It is also often referred to as split payments or ‘buy now pay later’.

![]()

In partnership with Oney, SSP is delighted to offer you a split payment solution with cash advance. While your customer pays in instalments, you receive the full amount up front from the very first payment. SSP offers secure payment solutions (with guarantees) to ensure payment collection. Oney takes care of setting up completely digital credit solutions.