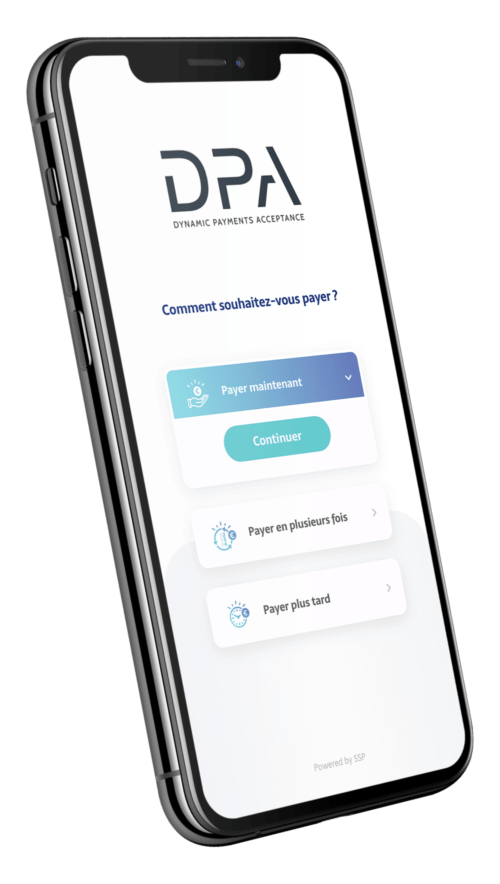

Find out more about DPA: An all-in-one solution for your remote or in-store payments

With DPA, SSP’s unique payment service platform, simplify and digitise your collections.

Thanks to DPA, you can:

- send payment links,

- offer different methods of payment,

- offer different means of payment,

- get paid in-store and remotely.

DPA allows you to:

- protect against payment failures,

- guarantee your payments,

- offer financing,

- increase your acceptance rate,

- boost your turnover.