SECURITY

Securing your transactions to fight against fraud.

With SSP omnichannel payment solutions, avoid payment refusals when taking customer bookings! In your sector, the average amount of transactions is often quite high, so there are real issues when it comes to transaction costs and acceptance rates.

Many refusals are linked to your customers’ credit card limits, so you need to think about adopting all existing payment methods on the market, i.e., cheques, credit cards or bank account payments (transfers, direct debits, or drafts).

GUARANTEE A GOOD TRANSACTION OUTCOME FOR YOUR CUSTOMERS

Some of your customers may want to pay immediately while others will prefer to benefit from payment facilities: paying in instalments or by deferred payments on days 30, 45 or 60. With SSP online payment solutions you take into account your customer’s purchasing power.

You can also initiate a transfer, which allows you to obtain a payment without asking your customer for credit card information over the phone, it’s easier than sending a payment link. Fast payment offered by SSP makes it possible to immediately block flights or services sold to the customer.

FIND OUT MORE ABOUT OUR PAYMENT SOLUTIONS

A multi-channel payment solution that secures cheque payment acceptance.

As the first bank account payment solution on the market, SAFEDEBIT allows you to securely collect transactions by bank account in a completely digital environment.

2 main payment methods with high added value:

This will be subject to a contractual guarantee in the event of non-payment and offers you flexibility in terms of payment methods (payment in full, instalment payments, deferred payments, payment carried over, security deposits).

It is you that initiates the transaction on behalf of the client.

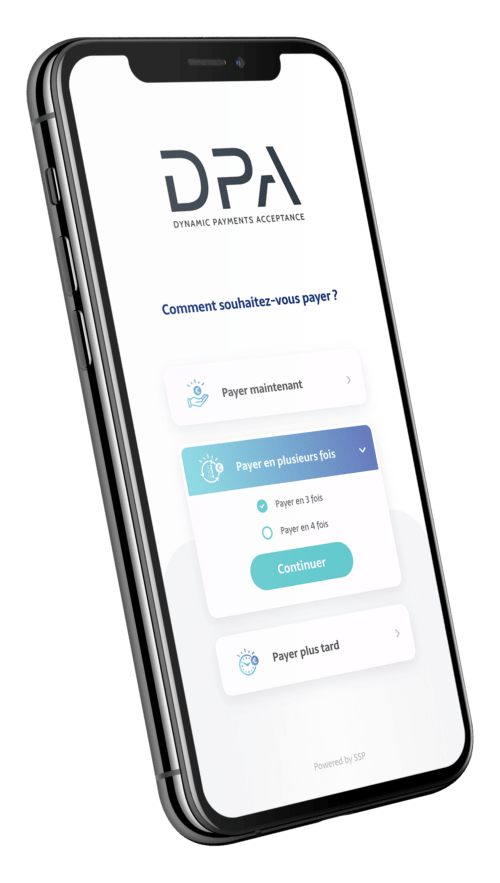

The DPA omnichannel payment platform gives your customer the option of paying now, in instalments, or at a later date. Your customer can also choose their payment method: Credit card, SAFEDEBIT or Cheque. With a dedicated Back-Office feature, you can manage your operations and have a consolidated view of recorded payments (Dashboard, payment account Access, etc.).